Commercial Equipment Financing

No Hassle Financing with the Vendor of your Choice

- Up to $250k Application Only Financing

- Labor, Maintenance & Installation Included in Financing

- One Low Monthly Payment

- Same Day Approvals / Funding within 48 Hours

A+ Rating from BBB

Established in 1978. Over 40 years of serving small and mid-sized businesses.

Commercial Equipment Financing Made Simple

Quick & Easy No-Hassle Equipment Funding

We provide financing for almost any type of commercial equipment or software. Get the commercial financing solutions that your company needs when you need it.

Equipment Financing Solutions

Finance Commercial Equipment from Almost Any Vendor

Multiple Financing Options Available

If you need financing in order to purchase almost any type of equipment, as an equipment financing company we can offer you multiple finance options. Whether you wish to have an equipment financing agreement or an equipment lease agreement, we will work with you to find the best financing solutions for your business needs.

Get a quick, no-obligation equipment financing quote and one of our financing experts will help you determine the best options available to you.

Commercial Financing

- Brewery Equipment Financing

- Commercial Equipment Financing

- Construction Equipment Financing

- Used Bulldozer Financing

- Mini Excavator Financing

- Equipment Financing

- Equipment Leasing

- Golf Course Mowers & Equipment Financing

- Business & Hospital Furniture Financing

- IT / Technology Financing

- WISP Financing

- Lab Equipment Financing

- Law Firm Technology Financing

- Material Handling Equipment Financing

- Medical Equipment Financing

- Medical Software Financing

- Restaurant Equipment Financing

- Recycling Equipment Financing

- Small Business Loans

- Software Financing

- Software Renewal Financing

- Tree Service Vehicles & Equipment Financing

- Working Capital

- Financing Application

Financing Made Simple

to your Clients

Benefits of Financing

Improve your cashflow

By spreading out the cost of big ticket equipment purchases, you keep your cash flow and working capital.

one, fixed monthly payment

No high upfront costs. Pay for equipment, shipping and associated costs spread out over a term that works for you.

easy application process

For financing under $250k you don't need financial statements. It's a quick online process with funding within a day, often within a few hours.

write off up to 100%

Under Section 179 of the IRS Code, you can write off most commercial equipment purchases. In some cases, up to 100% can be written off.

Quick & Easy Commercial Equipment Financing

100% Financing

Includes shipping, maintenance, third-party vendors and almost any costs associated with the purchase.

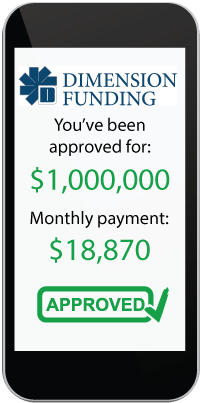

Same Day Approvals

Fast & easy electronic application process. Approvals usually within a few hours.

Preserve your working capital

Instead of a large outlay of cash which reduces your working capital, you have one low monthly payment.

Most Credit Ratings Accepted

Tier A to Marginal Credit. Most types of credit accepted.

ONE STEP FINANCING APPROVAL

Get a quick, no obligation, commercial equipment financing quote.

QUESTIONS? CALL US!!

1.800.755.0585

A+ Rating from the BBB.